Overview of Crypto and DeFi

Definition and Features of Crypto

Crypto is a term used to refer to electronic currencies that use cryptographic technology to protect privacy and secure transactions. These currencies are created and managed through a distributed system, without the need for intermediary organizations like traditional banks.One of the prominent features of Crypto is its high security. Transactions are encrypted using blockchain technology, ensuring that users’ information is secure and can not be tampered with. Additionally, the use of cryptography also helps prevent issues related to fraud and fake transactions.Another advantage of Crypto is its diversity. There are currently hundreds of different types of Crypto currencies, each with its own unique features and applications. Users can choose the currency type that suits their needs and usage purposes.

Definition and Features of DeFi

DeFi, short for Decentralized Finance, is a decentralized financial system built on the blockchain platform. The characteristic point of DeFi is its decentralization, meaning that no financial organization operates or controls transactions. Instead, transactions are carried out through encrypted information on the blockchain. One of the prominent features of DeFi is the ability to provide online financial services to anyone globally without going through traditional financial organizations. This is particularly useful for countries with weak economies and poorly developed financial systems.Other characteristics of DeFi include transparency, security, and cost savings. Transparency is an important factor in DeFi, allowing transactions to be tracked and verified on the blockchain. The security of DeFi comes from the encryption of information and the ability to protect accounts and data from online attacks. Finally, DeFi has a high cost savings due to not having to pay fees to intermediary financial organizations. In summary, Crypto and DeFi are both decentralized financial systems built on blockchain with decentralization, the ability to provide online financial services globally, transparency, security, and cost savings.

The Latest Applications of Crypto and DeFi

The latest applications of Crypto and DeFi are developing rapidly and can be divided into several different fields. In each field, they bring their own benefits, but also help to reap many benefits for that field in general and businesses in particular.

Yield Farming evolved from Crypto and DeFi

Definition and operation of Yield Farming

Definition: Yield farming is a method of generating profits from Crypto (cryptocurrency) through the use of decentralized financial platforms (DeFi). In the combination of Crypto and DeFi, investors use their Crypto to provide liquidity for transactions on DeFi platforms and receive higher returns than traditional transactions. This is often done through the use of decentralized financial protocols such as Compound, Aave, or Yearn Finance to deposit Crypto into smart contracts and receive reward tokens distributed by these protocols.Yield farming can also be used to profit from the difference between interest rates of different protocols. For example, if one protocol offers a higher interest rate than another, investors can deposit their Crypto into that protocol to take advantage of higher returns.

Operation: In DeFi, transactions are conducted using smart contracts and decentralized financial services to allow users to transact and borrow/lend with their Crypto.Yield farming in DeFi is the process of generating profits by providing your Crypto to a decentralized financial protocol and receiving a certain profit in the form of other Crypto. This profit is generated from interest rates, bonuses or transaction fees on the DeFi platform. These profits can be very high, however, like any investment activity, they also come with corresponding risks.For example, a DeFi protocol may allow users to deposit their Crypto into a smart contract and receive daily interest in some other Crypto. Users can seek out the highest yielding protocols and invest in them to maximize their profits through the combination of Crypto and DeFi.Some DeFi protocols also provide users with their own tokens to incentivize the use of their platform. These tokens can be used to reduce transaction fees or receive higher returns from depositing Crypto on the platform. Users can invest in these tokens to take advantage of potential profits that can be generated from using the DeFi platform.

NFTs (Non-Fungible Tokens) in Crypto and DeFi

The Definition of NFTs

Non-Fungible Tokens (NFTs) are a standard type of token on the blockchain, used to represent a unique and irreplaceable asset. In both blockchain and DeFi (Decentralized Finance), NFTs are becoming an important part of how assets are processed, registered, and managed.

How NFTs work

NFTs are created using a blockchain such as Ethereum, Solana, Binance Smart Chain, or Polygon. Each NFT contains information about the owner’s wallet address and information about the asset it represents. This asset can be anything, from a digital artwork to a video, game, music, medical chart, or even an excerpt from a book.NFTs are created using a process called “minting,” a process similar to mining Crypto on the blockchain. When an NFT is created, it is assigned a unique and unchangeable value. NFT owners can sell or exchange them with others on NFT trading platforms.

NFT projects in Crypto and DeFi

Currently, there are many NFT and DeFi projects being deployed on different blockchain platforms. Below are some notable NFT and DeFi projects:

- Decentraland

Decentraland is an NFT project of the blockchain and cryptocurrency community, which combines with DeFi to create a decentralized virtual world platform. Decentraland is built on the Ethereum platform and allows users to create and exchange NFTs, especially NFTs related to land in the Decentraland virtual world. These NFTs can also be used to create other games and applications on the Decentraland platform. In addition, Decentraland also integrates DeFi features, allowing users to borrow and lend digital currencies, perform exchange transactions at lower costs than traditional financial centers. Decentraland and DeFi are considered potential applications of blockchain and cryptocurrency, allowing users to access decentralized assets and trade directly with each other without going through intermediaries. However, like any new technology, Decentraland and DeFi also have their own risks and challenges, including security issues and risk management.

- Meebits

Meebits is an NFT project developed on the Ethereum platform. This project allows users to buy and own unique and valuable digital tokens called Meebits. Each Meebit is a 3D digital character with a unique design and stored in an Ethereum smart contract. Users can own and trade Meebits on various NFT trading platforms, and the value of each Meebit depends on market rarity and demand.Meebits also integrate features of DeFi (decentralized finance), allowing users to lend and borrow digital currencies, conduct direct exchange transactions with each other, and earn profits from holding Meebits tokens. The Meebits project is considered a successful example of combining NFT and DeFi, enabling users to access decentralized assets and trade directly with each other without intermediaries.

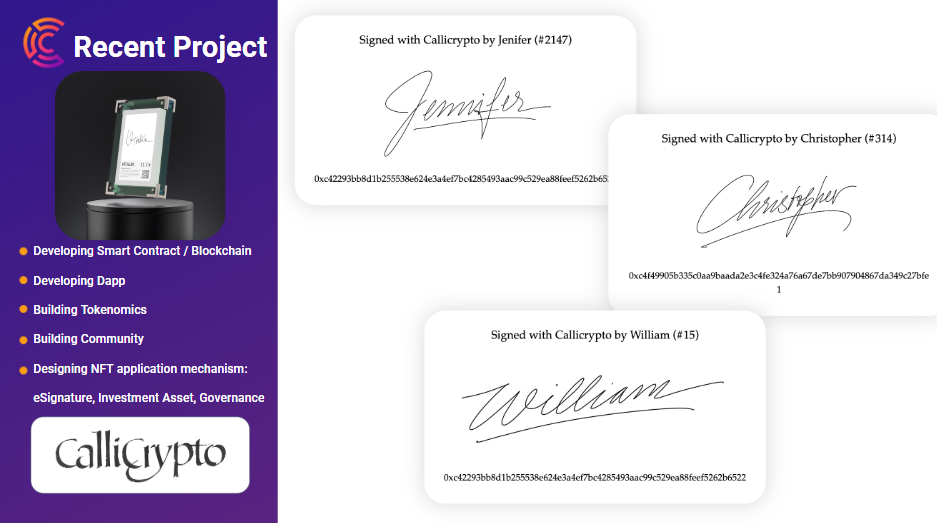

In the field of art, NFTs in Crypto and DeFi are also strongly developed, such as CryptoArt and Game NFTs. One notable project in this area is Callicrypto. Callicrypto is an NFT (non-fungible token) platform that allows users to purchase and own unique digital tokens. Each Callicrypto is a digitized image with a unique design stored on the Ethereum blockchain. Users can own and trade Callicryptos on the Callicrypto platform, and the value of each Callicrypto depends on its rarity and market demand. The project also integrates DeFi features, allowing users to lend and borrow digital currencies, conduct direct exchange transactions with each other, and earn profits from holding Callicrypto tokens.

Lending and borrowing

Lending and borrowing are important Definitions in the Crypto and DeFi (Decentralized Finance) fields, and are ways for users to generate profits from the growth of the Crypto market. Lending is the process of allowing users to lend their Crypto to others, usually through a DeFi platform. The lender provides the required amount for a certain period of time and receives it back with predetermined interest. Borrowing is the process of borrowing Crypto from others, usually through a DeFi platform, with the purpose of using the borrowed amount to invest or trade other Crypto. The borrower must ensure that they have enough credibility to repay the borrowed amount and interest at the agreed time. DeFi platforms often provide tools to automate the lending and borrowing process, helping users find the best opportunities to lend and borrow Crypto with the best interest rates. Loans and lending are often secured by using digital assets such as Bitcoin or Ethereum to ensure the safety and reliability of the transaction. The process of lending and borrowing in Crypto and DeFi is similar to traditional forms, but is carried out through a decentralized network and using Crypto such as Bitcoin or Ethereum. Here are some basic steps in the process:

- The lender sets the required amount and interest rate on a DeFi platform. Loans and lending are often secured by using digital assets such as Bitcoin or Ethereum to ensure the safety and reliability of the transaction.

- The borrower then requests the necessary amount and provides a collateral digital asset. If the loan is approved, the borrower receives the borrowed amount and must repay it with interest at the agreed time.

- During the loan period, the lender can withdraw or add to the amount lent. The lender can also use DeFi tools to automate the lending and borrowing process, helping to find the best opportunities to lend and borrow Crypto with the best interest rates.

- Finally, when the loan ends, the borrower must repay the borrowed amount with the agreed interest rate. If the borrower cannot repay this amount, their digital assets are used to compensate for the loan.

Staking and Governance in Crypto and DeFi

Definitions Staking and Governance are two important definitions in the fields of DeFi (Decentralized Finance) and Crypto. Here is a basic description of Staking and Governance. Staking is the process of locking a certain amount of Crypto to support the operation of a Crypto network. When users start staking, they allow the Crypto network to use the locked amount to support transaction verification on the network. Meanwhile, users receive Crypto rewards as interest for supporting the network. Governance is the process of participating in the management and decision-making of a Crypto project or a DeFi platform. Users can contribute opinions and vote on important decisions, such as changing the project’s codebase, updating features, or interest rate regulations. Users who participate in the Governance process usually receive Crypto rewards and are considered “owners” of the project. In reality, Staking and Governance are often combined in Crypto and DeFi projects, allowing users not only to support the network but also to influence the project’s management decisions.Characteristics of Staking and Governance Below are some characteristics of Staking and Governance in the fields of DeFi and cryptocurrency:Staking:

- Staking is a way to support the operation of a cryptocurrency network.

- Users lock a certain amount of cryptocurrency and receive cryptocurrency rewards as interest.

- Staking helps increase the safety and reliability of the cryptocurrency network by limiting the ability of malicious attackers.

- DeFi platforms often provide tools that allow users to easily perform staking and automate the process.

Governance:

- Governance is the process of participating in the management and decision-making of a cryptocurrency project or a DeFi platform.

- Users can contribute opinions and vote on important decisions, such as changing the project’s codebase, updating features, or interest rate regulations.

- Users who participate in the Governance process usually receive cryptocurrency rewards and are considered “owners” of the project.

- Governance tools are often designed to ensure fairness and diversity in the decision-making process.

Combining Staking and Governance:

- Staking and Governance are often combined in Crypto and DeFi projects.

- Users not only support the network but also influence the project’s management decisions.

- Combining Staking and Governance can help increase the safety, reliability, and fairness of the network and project.

Staking and Governance Projects in Crypto and DeFi

- Metacade

Metacade (MCADE) is a token of Metacade, a blockchain-based entertainment platform. The platform provides users with entertainment games and allows them to earn money through playing and creating content. Metacade uses blockchain technology to provide users with ownership and management rights over their content. This ensures that users will always have control over their content and can earn money from it. In addition, Metacade also provides a positive gaming community, allowing users to communicate and exchange with each other. The MCADE token is used in the Metacade ecosystem to pay for services and products, such as purchasing games and content on the platform. At the same time, MCADE is also used to reward positive behavior on the platform and to distribute profits to developers and content owners.

- Polkadot

Polkadot is a multi-chain, heterogeneous, and scalable technology. The network can connect multiple separate blockchains into a unified network and allow them to exchange data with each other safely. Polkadot has the ability to connect all blockchains from public to private. Specifically, a separate blockchain in the Polkadot ecosystem is called a parachain and parathreads. The main chain is called Relaychain. The idea is that parachains can easily exchange information with each other and are protected by Relaychain.

- Rooster Battle

Rooster Battle is a decentralized game based on blockchain technology released by Coming.io. In Rooster Battle, players can own virtual roosters and put them into combat matches with each other. Each rooster is built based on a unique code and has its own attributes, such as strength, speed, and durability. Players can enhance these attributes by using items and equipment for their roosters. In a Rooster Battle match, two roosters will face each other and the winner will belong to the rooster with higher strength and better durability. Players can place bets and receive rewards if their rooster wins. Rooster Battle is developed on the blockchain platform and uses smart contract technology to ensure transparency and fairness in matches. The game also uses virtual tokens (rooster tokens) to carry out transactions and exchanges between players.

These are some of the Crypto and DeFi applications being developed and updated in 2023. These applications bring a lot of potential and opportunities for users to save, invest, and trade safely and effectively.Many DeFi projects are being implemented on different blockchain platforms, providing different products and services such as lending, exchange, staking, yield farming, and many more. Crypto and DeFi, Coming.io is always a reputable Blockchain service provider, ready to help your business grow with the advancement of technology.